Payments by cheques money orders may be made to the ETF Head Office at NarahenpitaETF office at ColomboFort and to the regional. Though this will make a dent to social security efforts it will help in cost-cutting for companies in short term.

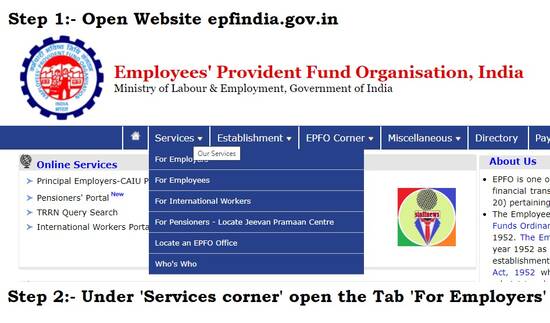

Epfo Launches Electronic Facility For Principal Employers To View Compliances Mint

The government may also pitch in for companies and pay the company contribution.

. RPFC went on appeal Surya Roshni Ltd. In view of all above. The Indian Contract Act uses the word surety for guarantor and Section 128 of Indian Contract Act very clearly states that the liability of the surety is co-extensive with that of the principal debtor unless it is otherwise provided by the contract.

Employment contract is for a minimum period of 2 years. Calculation of taxable interest relating to contribution in a provident fund or recognised provided fund exceeding specified limit- 1For the purposes of the first and second provisos to clauses 11 and 12 of section 10 income by way of interest accrued during the previous year which is not exempt from inclusion in the total income of a person under the said. Date Indicate the name of the department you will give the letter to Indicate the name of the company or institution that department belongs Dear Colleagues.

In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution. Along with the EPF Composite Claim Form you have to request EPFO Commissioner to issue the certificate in relation to the last 3 months EPF contribution and also the balance as of today. The form for the same can be downloaded from Download Application to obtain a certificate of EPF withdrawal for the house flat or construction of property.

C Donation to libraries. The High Court directed the Company to enrol all eligible contractual employees under the EPF Scheme and deposit their contribution with Respondent No3 Regional Provident Fund Commissioner from the date they became eligible till remittance and thereafter till they are in employment of the Company. Repatriation It is possible for foreign nationals to repatriate their earnings in India to their family abroad.

For business visits RBI approval may be needed. Employer contribution will be split as. But most of our contract staff are EPF members for year and demand EPF contribution by employer.

Any extra contribution will go into EPF. The Code was introduced in December 2019 and the Parliamentary Standing Committee submitted its report. EPS contribution will be a maximum of 1250.

The companies should be given exemptions from EPF contributions if they dont lay off workers. Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work. They also need a letter from employer or letter of contract.

The Code on Social Security 2020 was born out of the recommendations of the Second National Commission on Labour which stated in its report that the current set of labour laws must be amalgamated based on subject-matter. All chequesBank drafts must be crossed and payable to Employees Trust Fund Board. Paying office to be indicated as General Post Office.

It is understood that employers liability to pay EPF is only upto statutory wage ceiling EPFO Circular dated 3118 whereby instructions issued after Supreme Court Judgement in Marathwada Gramin Bank have been reiterated. Dividends generated from EPF are also. To repatriate the foreign national must fill up the requisite repatriation form submit his salary slip or income proof as.

D Expenditure incurred in providing services public amenities and contribution to a charity or community project. Payments by money Orders should be made favoring Employees Trust Fund Board. Employment is a relationship between two parties regulating the provision of paid labour services.

B Expenditure incurred in respect of publication in National Language. Employees work in return for wages which can be paid. We all know that our colleague indicate the name of your colleague.

EPF contribution is that it qualifies for tax deduction by way of personal relief. You may write an informal solicitation letter to ask monetary contribution for a colleagues wedding gift. 367 into Employees Provident Fund EPF 833 into Employees Pension Scheme EPS 05 into Employees Deposit Linked Insurance Scheme EDLIS 05 for EPF Administrative Charges The contribution may also be restricted upto salary of 15000.

Special allowance was not linked to the consumer price index and not in the nature of dearness allowance and hence did not fall within the definition of basic wage. Companies themselves are engaging in positive responses. Format may be as follows.

E Expenditure incurred in providing and. The salary package includes 4 weeks paid College semester breaks employers EPF contribution and company medical insurance benefits. The salary package includes 4 weeks paid College semester breaks employers EPF contribution and company medical insurance benefits.

EPF is a great way to get someone other than yourself namely your employer to contribute to your retirement. Employer contribution will be split as. This was to be carried out latest by 31122018.

The guarantors liability is not restricted to only the borrowed amount. Teaching staff is covered within the meaning of basic wages for the purpose of calculating provident fund contribution. UPDATED 06062021 a Expenditure incurred in providing equipment for the disabled employee OKU.

EPFs dividends of 45 615 over the past five years are significantly more attractive.

Frequently Asked Questions On Epf Pdf Free Download

Is Pf Deduction Mandatory For Salaries Of More Than 15000 Quora

All About Voluntary Provident Fund Vpf Youtube

India What S In A Comprehensive Employee Benefits Package

Epf Contract Employees Responsibility Of Principal Employer Youtube

Basics Of Employee Provident Fund Epf Eps Edlis

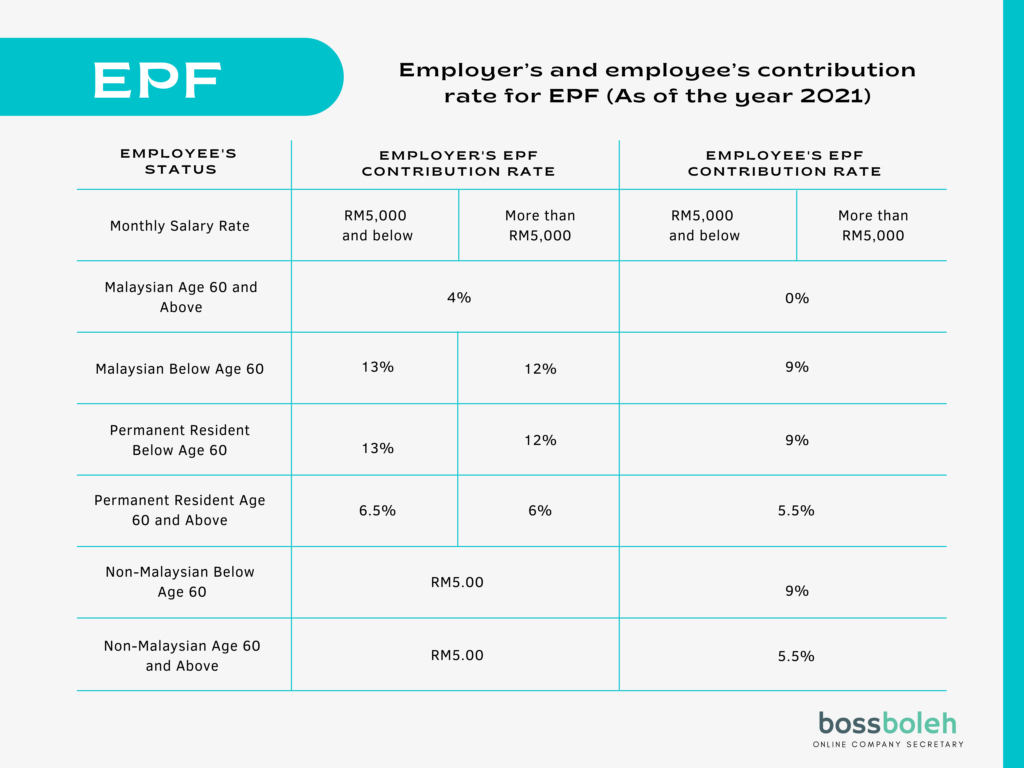

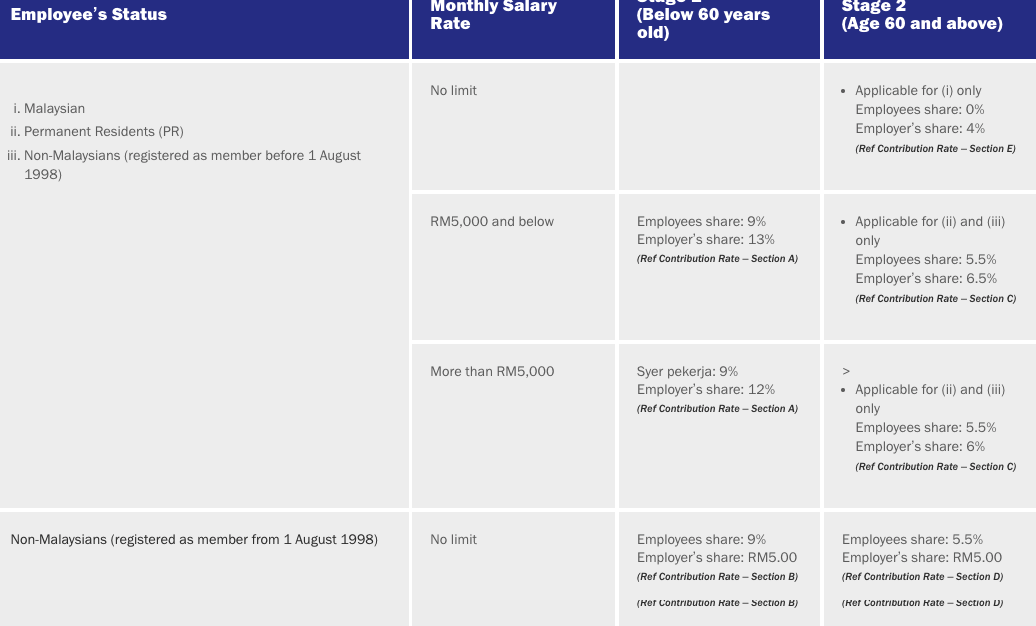

Contribution On Epf Socso Eis In Malaysia As An Employer Bossboleh Com

Frequently Asked Questions On Epf Pdf Free Download

Employee Provident Fund Epf Changed Rules From 1st Sept 2014

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Provident Fund Consultants Apply Epf Registration Online

Do You Know Epf Offers Up To Rs 6 Lakh Of Life Insurance Edli Basunivesh

Review Of Confirmation Of Payment Of Epf Contribution By Contractors In R O Of Outsourcing Staff Staffnews

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Frequently Asked Questions On Epf Pdf Free Download

Esi P F Consultants Deployment Of Electronic Facility At Employer Interface Of Epfo S Unified Portal For Principal Employers To View Epf Compliances Of Their Contractors And Contract Workers The Epf Mp

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird